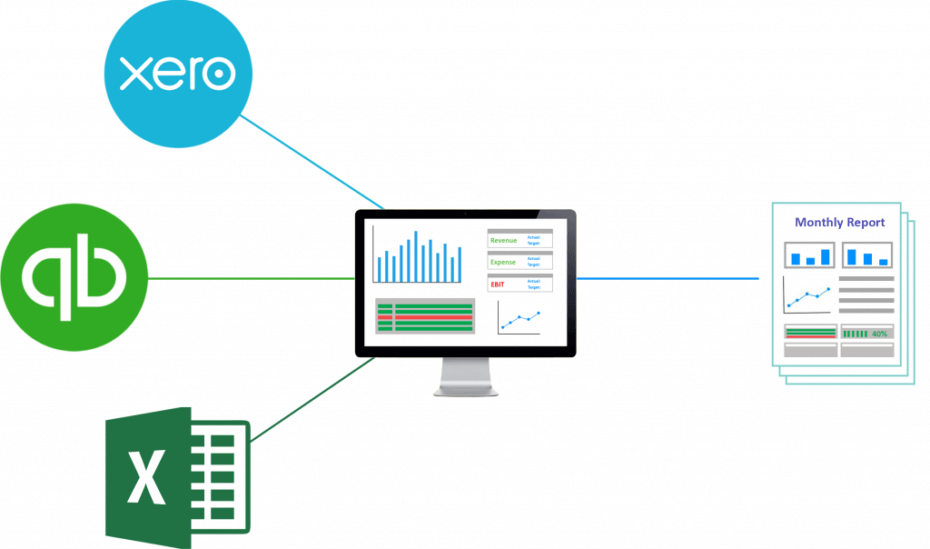

In the present day, accountancy and bookkeeping are to all intents and purposes virtual pastimes, and so depend critically upon the use of accounting software applications, much of which is now cloud based. Our mission statement expressly commits the co-operative to ethical practices, and in keeping with this we have undertaken a review of the ethical positions and practices of certain accounting software suppliers. We also wish to take a position where we can advise clients on this matter.

We have commissioned Ethical Consumer Research Association (ECRA) to review the practices of the providers of three software applications that we currently rely upon; Quickbooks online, Xero and Receipt Bank. We have contacted each of the companies and invited them to comment.

Quickbooks Online

Quickbooks online is a cloud-based accounts and bookkeeping application marketed by Intuit, and is widely used by smaller scale organisations. At first glance, and given the scale of the company’s operations, Intuit come out of the ethical screening relatively well: this is not to say they are particularly good, as there are concerns about trading in oppressive regimes, political funding, company structures associated with tax avoidance, and less than fully adequate environmental reporting, although on this last point there are noted commitments to reduce the company’s carbon footprint and waste output. However, a specific accounting-related concern for Third Sector Accountancy is Intuit’s role in lobbying against the provision of a free online tax filing system by the US internal revenue service; we view this as profit motivated and ethically questionable behaviour. Intuit have not offered any comment on the ECRA report.

Xero

Xero is similarly a cloud-based accounting and bookkeeping software application, also widely used by smaller scale organisations. Xero’s ethical rating is lower than Intuit’s, although with some important qualification: the company itself is faulted on its environmental reporting, but otherwise is not found to engage in unethical practices. However, as a publicly listed company, Xero has investors with significant shareholdings who, to put it mildly, engage in a wide range of ethically questionable practices. These investors include HSBC, J. P. Morgan and Citicorp.

In response, Xero say they have introduced a ‘Net Zero’ policy aimed at offsetting 100% of Xero carbon emissions. They also state that large investment institutions generally act as custodians for investors who are individuals and companies, and that as a publicly traded company they have no control over who holds or invests in Xero. Xero also assert that they have undertaken a number of initiatives under their Social Environmental Impact program, which they claim as evidence of their commitment to ethical investing. We have some sympathy for Xero’s claims, and can acknowledge their stated commitment to ethical practices. However, it remains the case that the decision to become a publicly traded company was made by Xero themselves: consequently, they are responsible for any associations that arise. Xero’s full response can be seen here.

Receipt Bank

Receipt Bank provides a pre-accounting software package, designed to automate bookkeeping tasks. Receipt Bank’s ethical rating is low, significantly less than for Xero or Intuit, yet like Xero the business itself is faulted only for its poor standard of environmental reporting. Again, the ethical standing of Receipt Bank is significantly affected through its association with shareholders, such as Insight Venture Partners and Kennet Partners, who in turn are known to invest substantially in ethically challenged businesses. Receipt Bank have offered a correction to ECRA’s report (they say they have 10,000 clients globally, and do have published accounts for which a non-working link was provided). However, they make no substantive rebuttal of the points made in the ECRA report.

As in many areas of life where aspiring for an acceptable ethical stance, making an appropriate decision presents something of a dilemma: in order to function effectively the co-op has to make use of applications that effectively meet our accounting requirements, and we have found that there is an unfortunate need to trade these requirements off against our ethics policy. We have come to understand that suppliers of accountancy software, who are without question ethical in their practice and also meet our requirements, are impossible to find. At best, we can commit to continue seeking viable alternatives that meet our ethical expectations and professional requirements. We also undertake to share any information we have concerning the ethical behaviour of our software suppliers, and so allow our clients to make their own informed decisions. As it is, ethically grounded alternatives that may be suitable for organisations with less complex bookkeeping requirements are currently available, these being Gnucash (a basic, open source desktop application) and open source spreadsheet applications such as Libre Office and Open Office.